Biomass Pellet Fuel Market in Italy

1. Regulatory framework market drives and barriers

As for most of the European member states, the main policy updates and the major changes in the regulatory framework exert a huge impact upon the Italian biomass and pellet sectors derived by the transposition and implementation of the principles released from the EC Renewable Energy Directive 28/2009.

The Italian target for renewable energy in the heating sector aims at 17.09 % by 2020 as stated in the National Renewable Energy Action Plan, a sensible increase from the 6.53% share of 2010. As a matter of fact the Italian NREAP forecast a predominant role for solid biomass in the heating sector, with an increase from 1.6 million Tons in 2010 to 5 million Tons in 2020.

According to the Italian NREAP, in 2020 solid biomass is expected to cover 50% of the RES share in the heating sector, increasing from 2,000 kToe of 2008 up to over 5,000 kToe of 2020. Therefore, biomass will play a key role in meeting the Italian 2020 target particularly in the heating sector.

In order to achieve this ambitious target, a series of support measures will have to be put in place not only to mobilize additional biomass sources, but also to stimulate the demand of biomass energy in the heating sector and promote the installation of new biomass units (boilers, district heating network, pellets stoves etc.).

The current (2010) system of support measures for biomass heating in Italy is centered on three main axes:

• Energy efficiency certificates (white certificates): this is a market mechanism aiming at promoting energy-saving projects in industrial, residential, services and agricultural sectors;

• Tax relief for energy saving in buildings: Tax relief of the 55% of total costs borne for energy efficiency improvement in buildings and/or installation of solar panels, biomass boilers and heat pumps;

• Mandatory quota of RES for new buildings: Minimum 50% of energy consumption for hot water production to be covered by RES in new buildings.

In March 2011 the Italian transposition law of the EU Renewable Energy Directive was adopted (Dlgs. 28 of 3 March 2011). This law introduces several major improvements in the regulatory context for biomass heating that once becoming fully operational will hopefully boost the adoption of biomass heating systems including pellet stoves and boilers.

Some of the main innovations introduced by the law are:

• Mandatory integration of RES systems in new buildings or old buildings subject to major renovations (art. 11);

• Simplification of authorization procedures for new heating and RES systems;

Introduction of mandatory “district heating and cooling plans” to be developed by municipalities with more than 50.000 citizens;

• Introduction of a loan guarantee fund for the installation of district heating networks;

• Introduction of incentives for RES heating and energy efficiency in small scale applications (to be further specified and regulated by ministerial decrees);

• Measures for the modernization of the system of energy efficiency certificates (white certificates).

According to estimates of the Italian Association of Wood Energy (AIEL) in 2009, over 22 million tons of biomass in various forms were consumed for energy purposes, with an overall market value of nearly 2,300 million euro. The demand is almost exclusively generated by the consumer market for space heating in residential buildings. The main driver is therefore represented by the market of pellet stoves and boilers that have been growing steadily since 2003 and accounted for over 1,200,000 units in 2010, most of them being pellet stoves with average installed capacity of 7-10 kWth and a much smaller share being pellet boilers of slightly higher power capacity (14,000-15,000) units. Forecasts for 2011 predicted more than 1,400,000 units installed. According to a report published in 2011 by the Energy Strategy Group of the Politecnico di Milano, the market of pellet stoves had experienced a steady growth of 10% per year since 2008. Over 220,000 new pellet appliances were installed in 2010 (+ 20% compared to 2009). There are several drives behind the expansion of this market such as:

• The economic competitiveness of wood pellet versus other fuels such as LPG and heating oil that are still the main fuels used in several decentralized rural areas not served by the natural gas grid network;

• The availability of tax incentives (55% tax relief as specified in the above paragraph) and grants especially for rural areas;

• The presence of a mature and dynamic sector of stove manufacturers providing a wide range of solutions from entry level to high design products.

The relative cost competitiveness of pellet heating is therefore the main driving force behind market expansion. As a matter of fact, despite the increasing trend of pellet prices, the annual costs of a pellet stove are still as competitive as a traditional natural gas boiler.

READ: GET TO KNOW KINGMAN PELLET STOVE AND FIREPLACE NOW

2. Production capacity and feedstock

In 2008 and 2009 the cumulative pellet production of Italian manufacturers was estimated around 800,000 tons, increasing since 2007 when it was around 650,000-700,000 tons.

In 2010 between 70 and 80 producers were operating, most of them declaring a small production capacity in the range of 15,000-20,000 tons per year. Over 70% of the production is located in the northern regions, due to the relatively higher abundance of raw material and a more developed wood industry in these areas. Several manufacturers are companies involved in the wood industry as primary activity, (sawmills, furniture manufacturers), that produce large quantities of sawdust and therefore produce pellet as secondary activity.

Raw materials used in pellet production are mainly constituted by residues of the wood industry with 65% of sawdust, 19% of shavings, 5% of rough discards, whereas chips and other residues represent 11%.

In the last 2-3 years several manufacturers experienced difficulties in sourcing feedstock at competitive prices, due to the rising competition of other manufacturing activities such as that of fiberboards and furniture, but also to the increasing competition of a growing number of biomass plants, that in some cases have led to a concentrated demand of feedstock in some local areas.

3. Consumption

The demand for wood pellet has increased steadily since 2003, led by the growth of the pellet stoves sector. A sensible increase in the pellet market was observed in 2007, when the volume of pellets distributed reached over 1,000,000 tons, from around 650,000 tons in 2006.

In 2009 the consumption of pellet reached over 1,200,000 tons, and in 2010 it was estimated well above 1,400,000 tons, thus confirming Italy as one of world’s biggest and dynamic markets for high quality pellet. In Italy the large majority of pellets are used for space heating in the residential sector; it is estimated that 90% is consumed in stoves and the remaining 10% is used in boilers. The potential for growth in the domestic market is still quite high, and lies in the possibility of replacing old and inefficient traditional wood heating systems with modern stoves and boilers. Indeed according to recent estimates there are over 15 million traditional systems (fireplaces, wood ovens, boilers etc.) still operating in Italy with very low efficiencies.

4. Trade and logistic aspects

The increasing demand in the Italian market cannot be satisfied by domestic production and a large share of the market is currently covered by imports.

The estimated amount of imported pellets in 2010 varies between 680.000 tons (source: Polytechnic of Milan) and 1,054,000 tons (source: Eurostat 2011). This represents a market share between 48% and 72% respectively.

According to Eurostat in 2010, Austria remained the largest exporting country to Italy with nearly 400,000 tons delivered. Other important partners were Germany (147,000 tons), France (85,000 tons), Romania (76,000 tons), Slovenia (66,000 tons) and Lithuania (52,000 tons) respectively.

READ: PELLET FUEL MARKET ANALYSES OF GERMANY

For the first time in 2010, small volumes of imports were also recorded from overseas countries such as the U.S. (3,500 tons) and Canada (12,000 tons). This is an evidence that Italy is being increasingly seen as an export market by countries that had so far looked almost exclusively towards Northern EU markets for industrial pellet. Wood pellets are distributed to final consumers through 3 main channels: direct sale from producers, sale through stove and boiler providers and sale through wholesalers and retailers.

Over 70% of pellets are distributed through wholesalers and retailers. The large majority of pellets are sold in bags of 15-20 kg. In some regions of Northern Italy, pellet is also delivered in bulk with tank trucks mainly to owners of biomass boilers.

5. Pellets quality and standard

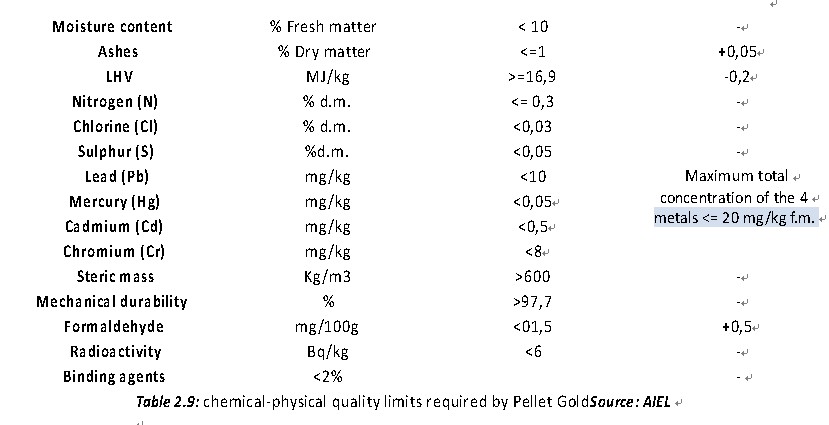

Since the only use of wood pellet in Italy is that of space heating in small-scale units, product quality has become an essential parameter of competitiveness in the Italian market. As a consequence of that, standards and certification assume an important role in ensuring and communicating quality to final consumers. As a matter of fact, until 2010 one of the most acknowledged quality assurance systems in Italy is the Pellet Gold label. Active since 2006, Pellet Gold is a third party voluntary system based on CEN/TS 14961, DINplus, ÖNORM M 7135 norms and on the limits introduced by the America Pellet Fuel Institute (PFI).The chemical-physical quality limits required by Pellet Gold are shown in the following table.

A major help for the standardization of the sector will derive from the introduction and application of the new European norms EN14961 and the relative certification system EN-Plus, as well as the introduction of the norm EN 15234-1 for the traceability of the supply chain, that will constitute an important tool to guarantee transparency and uniformity of labeling. In July 2011, AIEL (The Italian Association for Wood Energy) obtained the license for this certification system.

READ: BIOMASS PELLET MARKET ACROSS FINLAND

6. Price trends

Since 2009, the Chamber of Commerce of Milan has kept track and published the prices of wood pellets and other solid biofuels. Prices are updated every 4 months and are referred to the wholesale price of 15kg bags of quality pellet. As can be seen the prices show a seasonal variability, with higher prices in winter season and lower prices in spring-summer. In October 2011 the price of a 15 kg bag was reported at 4.10 € VAT included, corresponding to 273 €/ton.

-----------------------------------------------------------------------------------------------------------------------------------------------------

News

- Small Pellet Machine Manufacturer-Kingman

- Application of Wood Pellets and Use of Biomass Pellets

- From Fossil Fuel into Biomass Pellet Fuel

- Biomass Pellet Making Machines Market

- Applying of pellet stoves for home use

- Highland pellets to build $130 million facility in arkansas

- How to deal with the blocked hammer mill

- How to Make Wood Pellets with Sawdust

- The government policy promotes the development of biomass fuel

- Market analysis of biomass pellet fuel

- Strategic positioning of renewable energy

- Biomass energy has pass through the pre assessment

- The key point of deep processing of biomass pellet

- Harbin is promoting the development of biomass machinery

- The development of biomass formation technology I

- The development of biomass formation technology II

- Biomass energy industry is now going full tilt in 2015

- Rapid increasing demand of sawdust pellet on the market

- Pellet fuel market in EU

- Chinese Biomass Energy Conference held in Beijing

- Future market development of straw pellet mill

- Peanut Shell Pellet Mill Makes High Quality Pellets

- The utilization of straw is only 5%, biomass energy needs our attention!

- Corn straw pellet machine relieves the tight supply of fuel energy

- Reasons for loose or not forming of biomass pellet mill